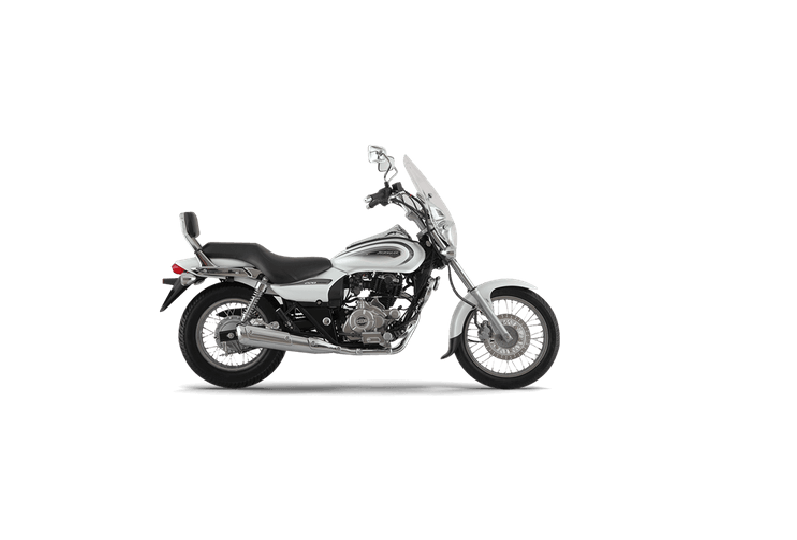

Are you planning to buy a new bike? If so then make sure that you are applying for a bike loan. Financing your bike is one of the best ways to steer clear of additional financial burdens. Furthermore, applying for a bike loan will also allow you to boost your credit score. With every EMI, your credit score and credit history will get a boost.

Countless lenders in India offer a myriad of bike loans.

So how can you tell which lender and which bike loan is right for you?

Well, that is pretty easy!

All you would need to do is follow the tips mentioned below while you apply for a two wheeler loan –

- First of all, always remember to research the lender you are about to choose. Make sure that the lender has a stellar online and offline reputation.

- Secondly, talk to people you know who have had previous dealings with the lender. If their experience was a positive one then choose the lender. If that is not the case then look for other options.

- Make sure that you are comparing the different bike loans offered by different lenders. Comparing bike loans will reveal the one that comes with terms that are on par with your unique requirements.

- Choose a lender that offers online bike loan application facilities.

- Make sure that the lender you are choosing is transparent with its terms and conditions.

- Always ensure that your credit history and credit score is excellent before you apply for a bike loan.

- Finally, always use the online bike loan EMI calculator tool available on the official website of the lender. Using this tool will give you an idea about the EMIs you would need to bear for the bike loan.

Must read: