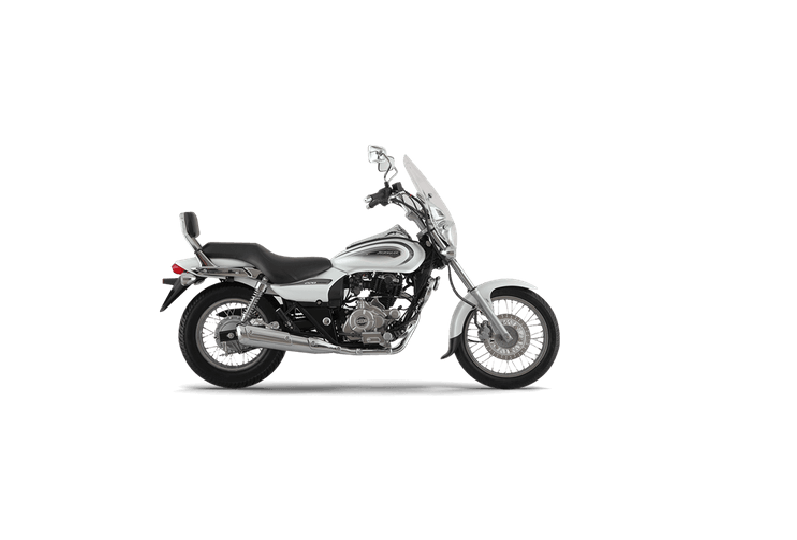

In recent years, the prices of motorcycles available in India have gone up by many folds.

Hence, it has become impossible for anyone to buy a bike with cash. The only solution is to apply for a bike loan. What about the high-interest rates that lenders tend to levy on borrowers? Well, borrowers can get low-interest rates if they follow the tips mentioned below.

Borrowers should consult multiple Lenders before selecting a Loan Scheme

NBFCs (Non-Banking Financial Companies) and Banks tend to levy low bike loan interest rates on bike loan schemes in a bid to remain competitive. The trick borrowers can apply is to consult multiple lenders. On top of this, borrowers can also choose to buy a bike during the festive season.

There are countless lenders currently running their operations in India. Hence, it is natural for competition among lenders to be fierce. When a lender understands that a borrower has been consulting with their rivals, low-interest rates will be offered.

It is as simple as that.

One can get Low-interest rates just by having a stellar Credit history

It is best for a borrower to apply for a motorcycle loan when they have never defaulted on debt repayments. Furthermore, borrowers who do not have any running debts with other lenders can also enjoy low-interest rates. In simple words, borrowers with stellar credit histories will be offered competitive bike loan interest rates.

One can get Low-interest rates when they have a high Credit Score

Borrowers with CIBIL scores above 750 would be offered low-interest rates when the former apply for a motorcycle loan. At the same time, borrowers with CIBIL scores below 750 will be levied high-interest rates. There could be instances where the lender simply rejects the loan application.

For more tips, it would be best to consult a professional financial advisor.

Must read: How To Calculate Two Wheeler Loan EMI?